Project Goals

- To generate additional

accounts and revenue.

Challenges

- Streamlining the application into five sections

- Reducing repetitive legal and compliance copy

Team

- Application Development

- Compliance

- Legal

- Marketing (project sponsor)

- Media Services

- Project Management

Result

It opened a new profitability channel that surpassed the highest three branches, saved company resources, and received customer praise for ease of use.

Steps

1

Team kickoff meeting

2

Research

- Review of the current application and process

- Competitive Analysis

- Examine Customer feedback

- Interview employees

- Best practices

- Survey screener

- Usability Testing

3

Current ways to open an account

The customer goes to a FirstMerit branch and asks about opening an account. One of the branch employees works with the person to fill out all the paperwork and open the account.

When the customer calls the toll-free phone number, a bank representative will assist the customer with opening an account.

For Reality and Gold checking only, the customer can select the “Submit a Callback Form” button on the Reality and Gold pages. The user then fills out some basic information and submits it. A representative will call the person back to complete the rest of the application.

4

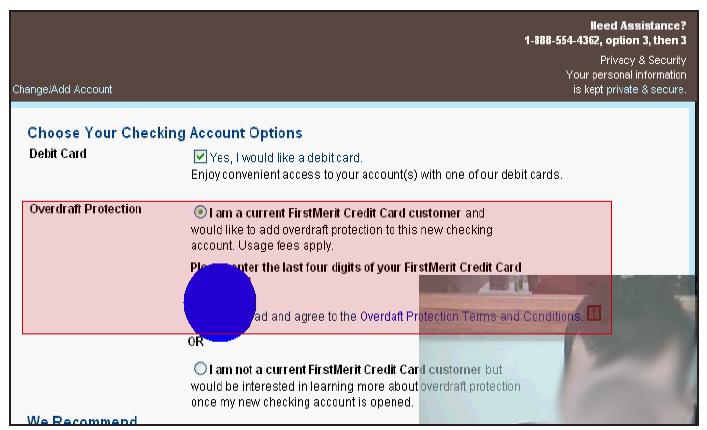

Define application capabilities and constraints.

- The user interface will match the color scheme and branding of the main website.

- The application has contact information that is easily visible in case users need help.

- Break down the application into sections to make it less overwhelming to customers and easier for server callbacks.

- The application must show progress and indicate where the customers are in the application.

- The labels are above the fields. The labels above the fields make for faster completion and let the user’s eye see both the title and the field simultaneously, compared to left or right-aligned labels. In “Web Form Design: Filling in the Blanks” by Luke Wroblewski, he shares evidence that labels above the fields are faster.

- The application is only for Reality Checking, Gold Checking, Reality Savings, and Statement Savings.

5

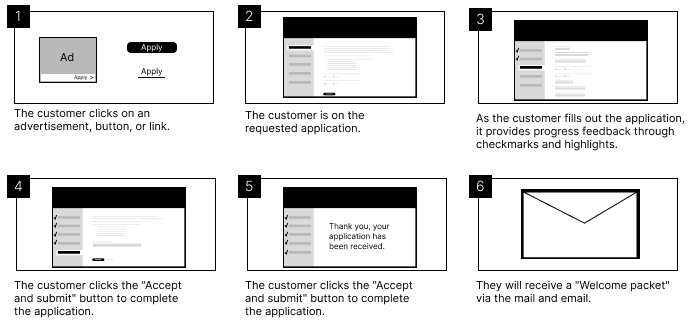

Create a high-level user flow of the new online account opening method.

6

Create wireframes, review, and revise. The mockup image points out the various areas of the screen.

7

Screener survey for usability testing

General questions

- Age: Under 18 | 18-25 | 26-40| 41-55 | over 55

- Do you live in Ohio | Pennsylvania | Michigan | or another state?

- Is English your native language? Yes | No

- Do you have a Social Security Number? Yes | No

- Do you have a Driver’s License or State ID number? Yes | No

- Do you have an email address? Yes | No

Banking Questions

- Do you currently have a checking account? Yes| No

- Do you currently have a savings account? Yes | No

- Do you bank online? Yes | No

Computer-Related Questions

- How often do you use a computer? Daily | Weekly | Monthly | Quarterly | Yearly | Never

- Which computer platform do you use? Microsoft Windows | Apple Macintosh | Other

- How often do you use the internet? Daily | Weekly | Monthly | Quarterly | Yearly

- Which internet browser do you use? Firefox | Internet Explorer | Other

- Have you ever completed a form online? Yes | No

- How often have you filled out forms online? 0 | 1-5 | 6-10 | 11-15 | over 15

- Have you ever signed up for an account online? Yes | No

- How often have you filled out accounts online? 0 | 1-5 | 6-10 | 11-15 | over 15

8

User profiles

Name: Laid-back Les

Age: Over 55

Occupation: Retired

Laid-back Les is a married retired worker with time on his hands. He runs a Windows computer and uses the built-in default browser. Les is on the computer daily to check email and surf the internet. He has filled out forms and signed up for accounts online but prefers signing up for in-person items. He has basic computer knowledge, but for significant problems with the computer, he will contact a support line or take it to a computer repair person.

Les has had a checking and savings account for many years and does not bank online. His transactions are in person, and he pays bills by writing checks. Les is not the targeted audience for the Online Deposit Application. Even though Les does not fit the targeted audience, he would be a good test subject for the user interface. His level of computer knowledge could provide insight toward finding out if the application is easy to use.

Name: Kool Kristi

Age: 26-40

Occupation: Homemaker

Kool Kristi is married with two children and is a stay-at-home mom. She has a master’s degree and formerly worked in corporate environments. She needs more time between keeping the house in shape, managing the kids and their many activities, exercising, and the many other daily tasks. Kool Kristi is also responsible for managing the household finances. She has a checking and savings account and handles the children’s accounts. She does most of her banking online and prefers to only go to the bank if there is no other option.

Kristi has filled out online forms and opened accounts. She primarily uses the computer for email, Facebook, surfing, shopping, and the kid’s school activities. Her laptop is Windows-based and uses the Firefox browser. She is familiar with websites and browsing but needs help with general computer upkeep.

Kool Kristi fits the profile of the targeted audience. She would give good feedback on a comparison basis with other sites and find out if the application needs to be shorter or if there are any sticking points.

9

User tasks for usability eye-tracking tests

We will be running test subjects through the following three scenarios:

- The user signs up for a new Reality checking account as an individual and funds it with a credit card.

- The user signs up for a new Reality checking account as a joint account and funds it from another checking account.

- The user starts to sign up for a Reality checking account and switches to a Gold checking account during the application. The scenario will be an individual account funded with a credit card.

10

Analyze usability test results, share findings, and modify the application.

11

Launch the application and monitor analytics.